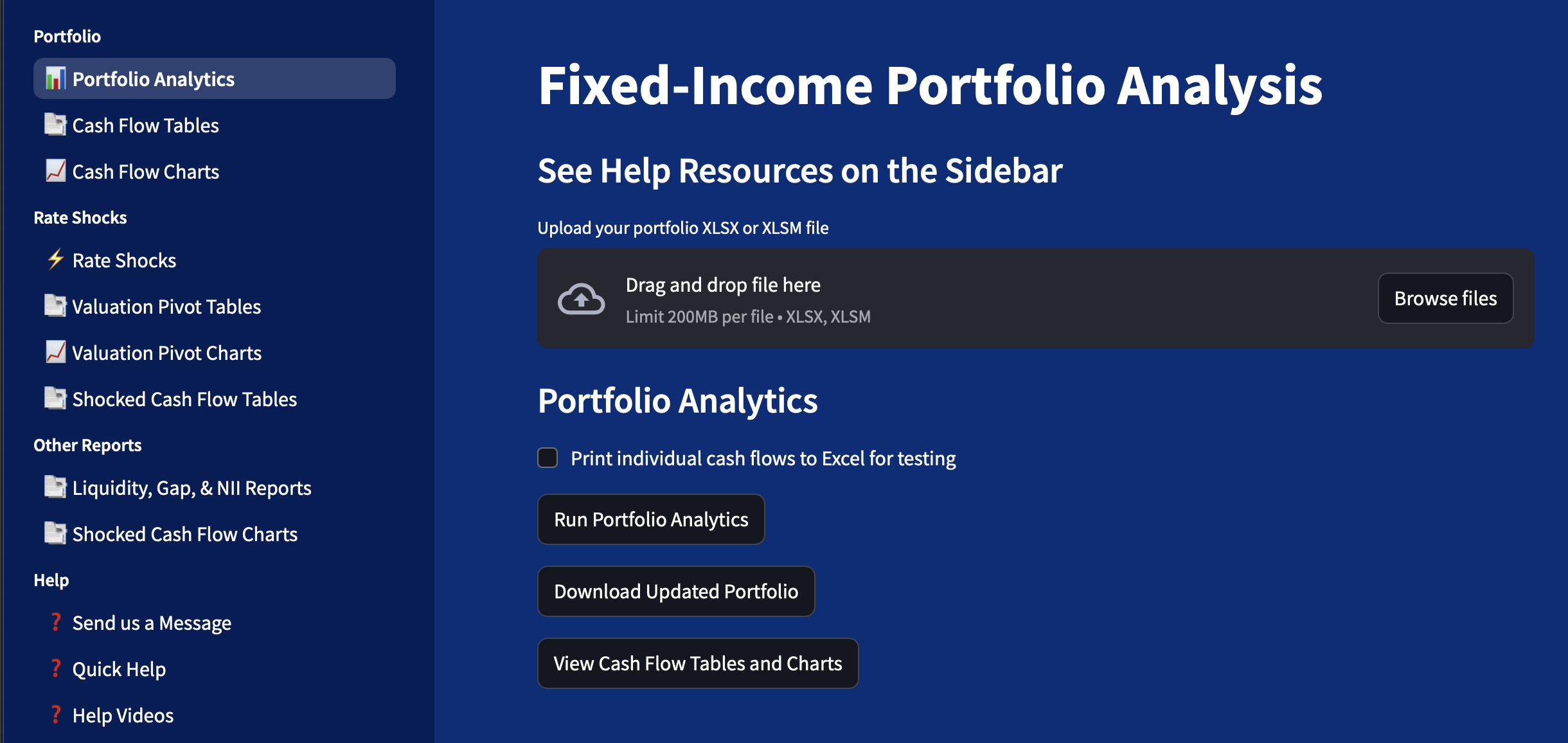

Cash Flow and Pricing Engine

Generate accurate loan, bond, deposit, and swap cash flows.

Calculate loan, bond, deposit, and swap prices, yields, modified durations, and convexities.

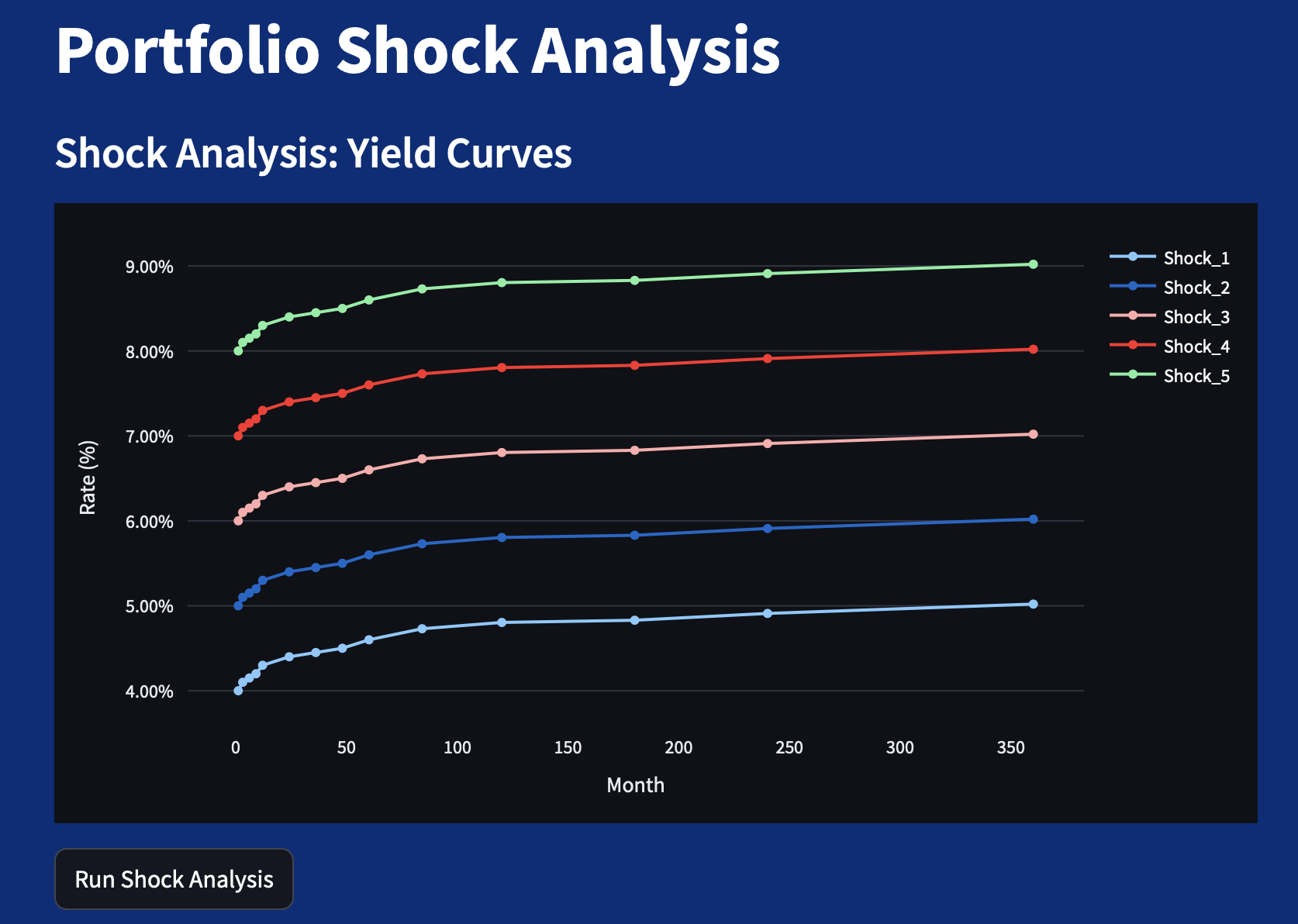

Rate Shock Scenarios

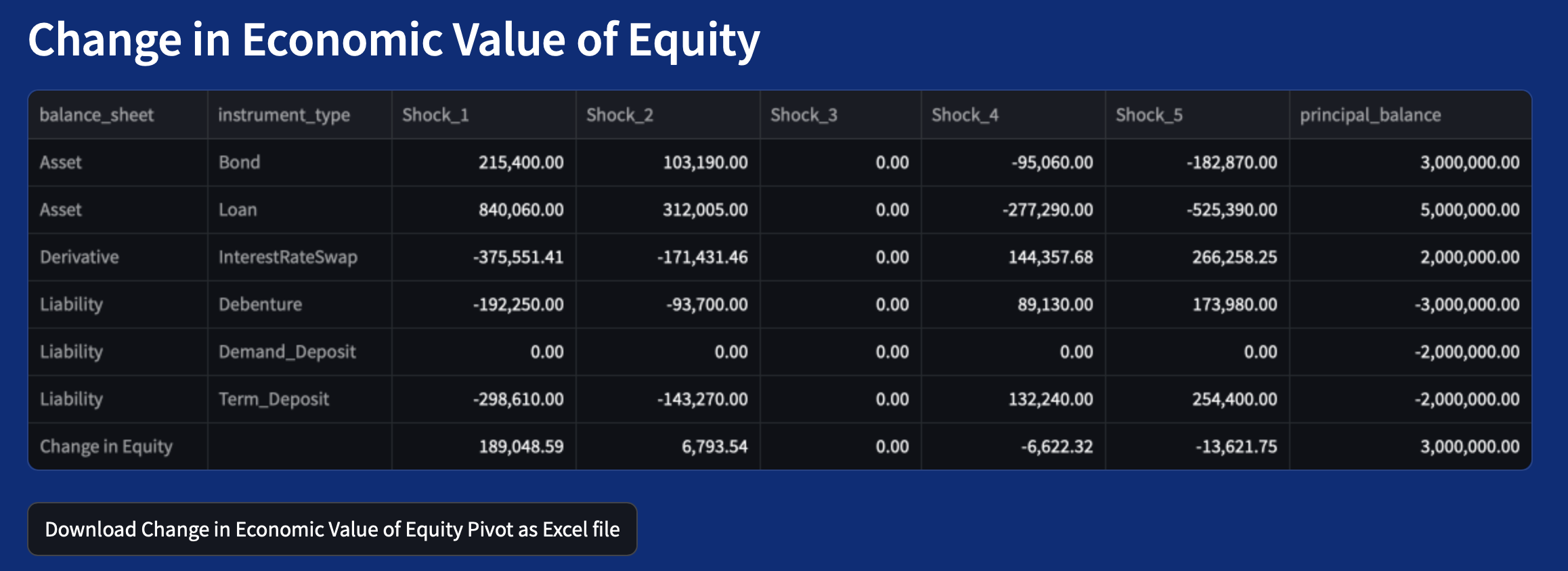

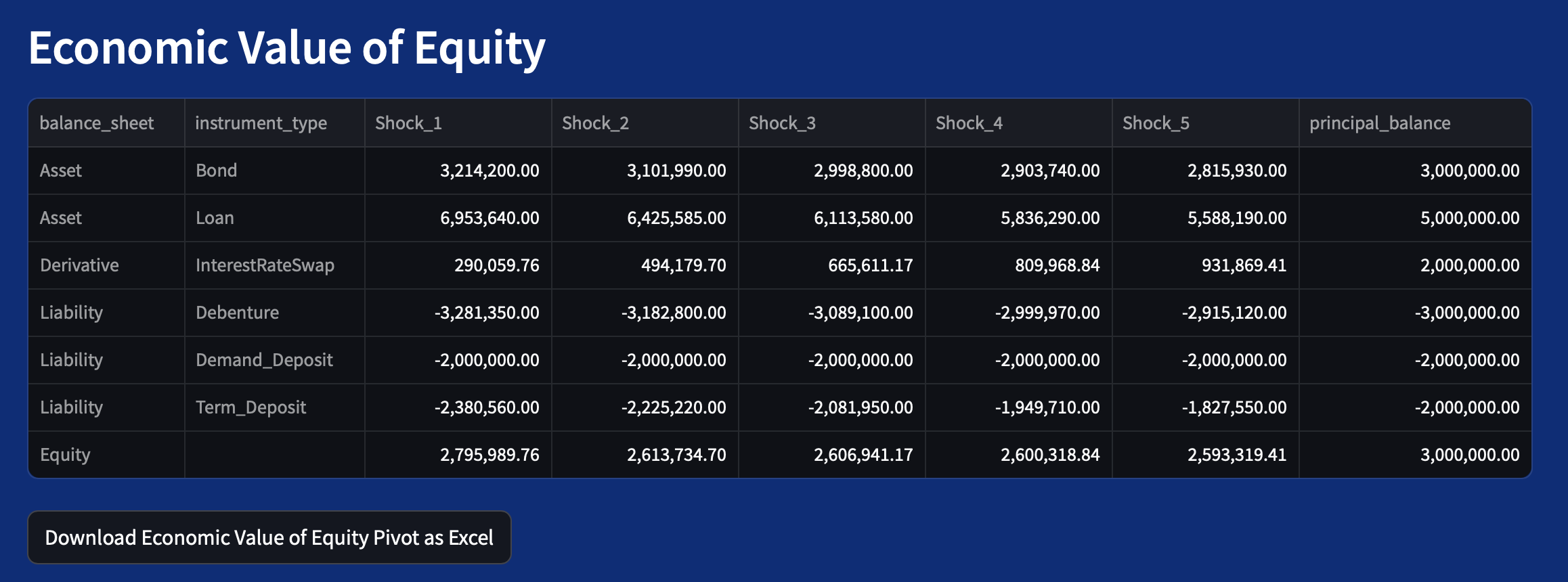

Run user-defined parallel and non-parallel rate shocks for portfolio market risk analysis.

Analysis includes pricing results of each shock for every position as well as results for aggregated valuations and aggregated cash flows at the instrument-type level.

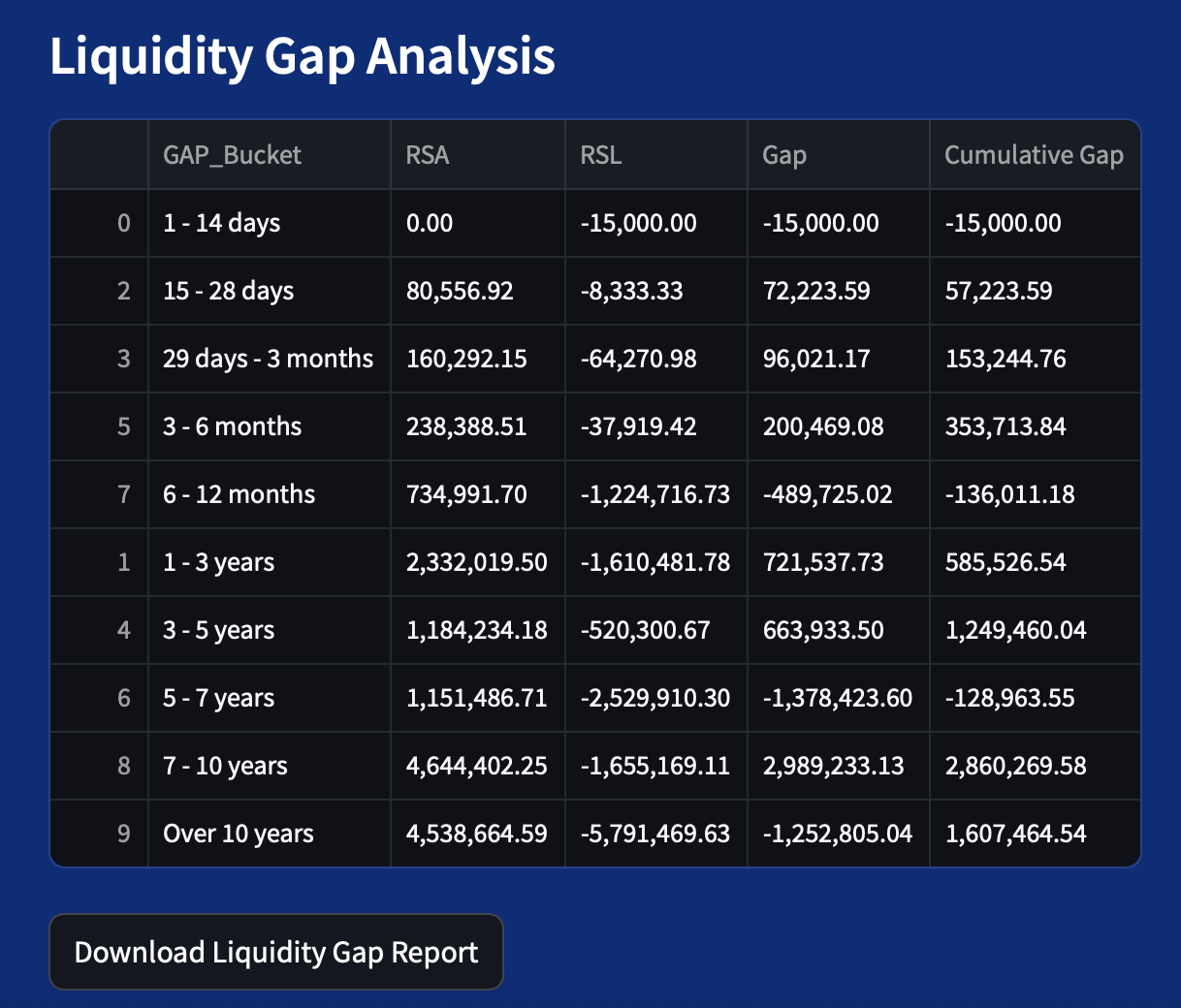

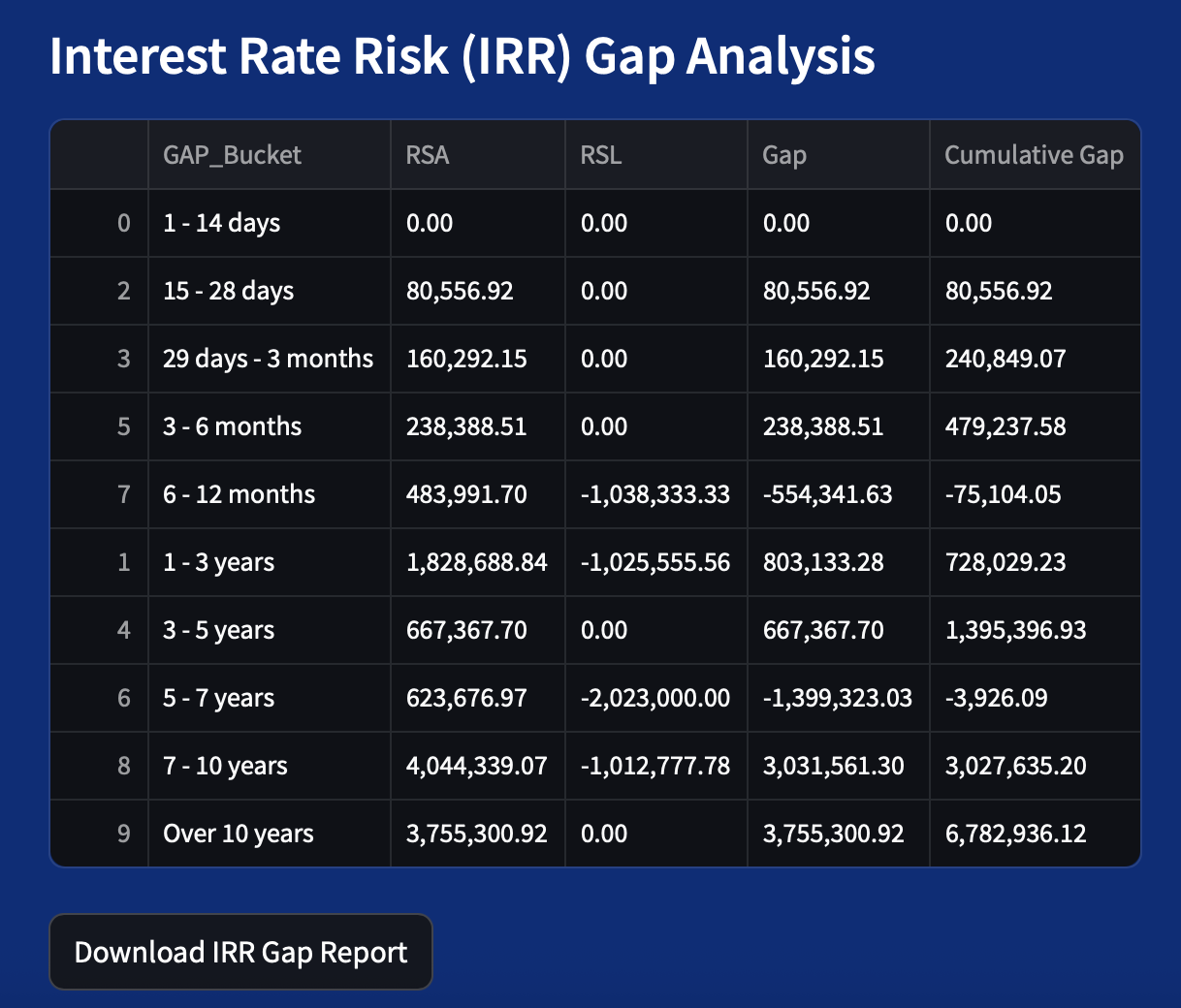

Regulatory Reporting

View and download formatted reports for interest rate sensitivity and liquidity disclosures.

Views of predefined reports from the NBFC ALM application have been made available at the bottom of this page for viewing.